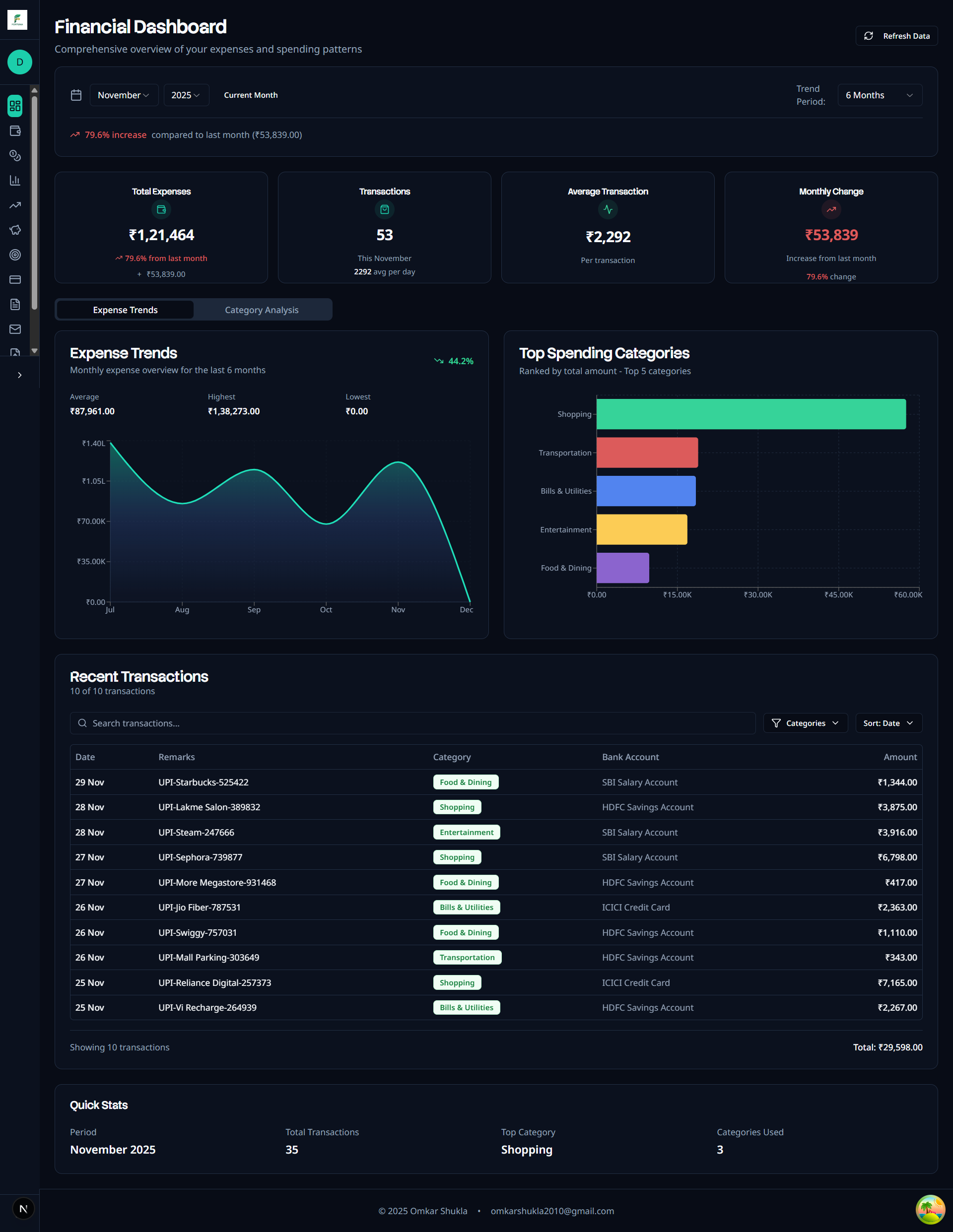

Building Fortuna: A personal finance app

Personal Finance for People Who Have Better Things to Do

Paul Graham has this great essay called “How to Get Startup Ideas” where he talks about building things you want for yourself. I wanted one place where I could check the financial health of me and my family. Not scattered across multiple apps, spreadsheets, and email folders. Just one place. One source of truth. With the new wave of GenAI tools (Claude, Gemini), I thought I would try building something that I want for myself.

But here’s the thing—I didn’t want another app that demands my attention every day.

The Philosophy: Life First, Money Second

Most personal finance apps are built on the assumption that you want to think about money constantly. Check your portfolio daily. Categorize every transaction as it happens. Read market news. Optimize. Trade. Repeat. I don’t believe in that approach. There are better things to do in life than think about money every day. Time with friends and family. Building things. Learning. Living.

So I built this app around a different principle: I want to decide when I want to think about my money..

How It Actually Works

For daily expenses: The app is designed to be used monthly, not daily.

- Learn from user - Understand past categorization and suggest for new expenses

- Email sync pulls in transactions from your inbox

- Bulk upload from bank statements

- You review and adjust once a month, not every day

For investments: True autopilot mode.

- No investments without goals. You must invest with a goal in mind. Keep it simple - Equity or Debt. No other asset classes.

- Link your investments to specific goals (retirement, house, education)

- Update the numbers and check progress once a year against the goal

- Bring in uncertainty since thats life. Be comfortable with probability ranges, not certainty of deterministic rate of returns - Thanks to Taleb and his works Black Swan and Antifragile

Who this app IS for: People who want to know they’re on track without obsessing. Set your goals, automate what you can, check in periodically, and get back to living your life.

Who this app is NOT for: Day-traders or people for whom making money is the full-time job.

Built in 4 Months (While working full-time)

I have a full-time job as a Product Manager during the week. Despite that and all other resposibilities that an adult has - I was able to build this within 4 months or so. GenAI didn’t write all the code, but it accelerated the parts that would have been tedious — setup project structure, boilerplate code, API routes, debugging obscure errors.

It let me focus on the core problems that I found way more interesting: How should retirement buckets work? What’s the right ML strategy for categorization?

The Bottom Line

This is what I wanted for myself: a comprehensive personal finance system that respects my time, keeps me in control, and abstracts away complexity without dumbing things down.

One place to track everything. Monthly reviews instead of daily obsession. Annual investment check-ins instead of constant monitoring. Goal-based planning instead of market timing.

Financial clarity without financial anxiety.

If that resonates with you, please follow along as I build Fortuna.

What’s Next: A Blog Series

This is the first post in a series where I’ll break down how I built Fortuna. In upcoming posts, I’ll dive deep into my experience of using Claude, Gemnini for building something.

Each post will cover the thinking, the tradeoffs, and the implementation details.

Thank you to my wife, Sukhada, for being the first alpha test user for this and helping me think about how I can make it easier for her to use.